Credit Union Cheyenne: High Quality Financial Solutions and Personalized Solution

Credit Union Cheyenne: High Quality Financial Solutions and Personalized Solution

Blog Article

Empower Your Finances With Cooperative Credit Union

Credit report unions have actually become a beacon of wish for people looking for to take control of their economic future. With a concentrate on personalized services, affordable rates, and neighborhood assistance, cooperative credit union provide a distinct technique to financial empowerment. By aligning with a lending institution, people can access a variety of advantages that may not be offered via conventional banking organizations. The inquiry remains: how can credit rating unions really transform your financial expectation and provide a stable foundation for your future ventures?

Advantages of Joining a Lending Institution

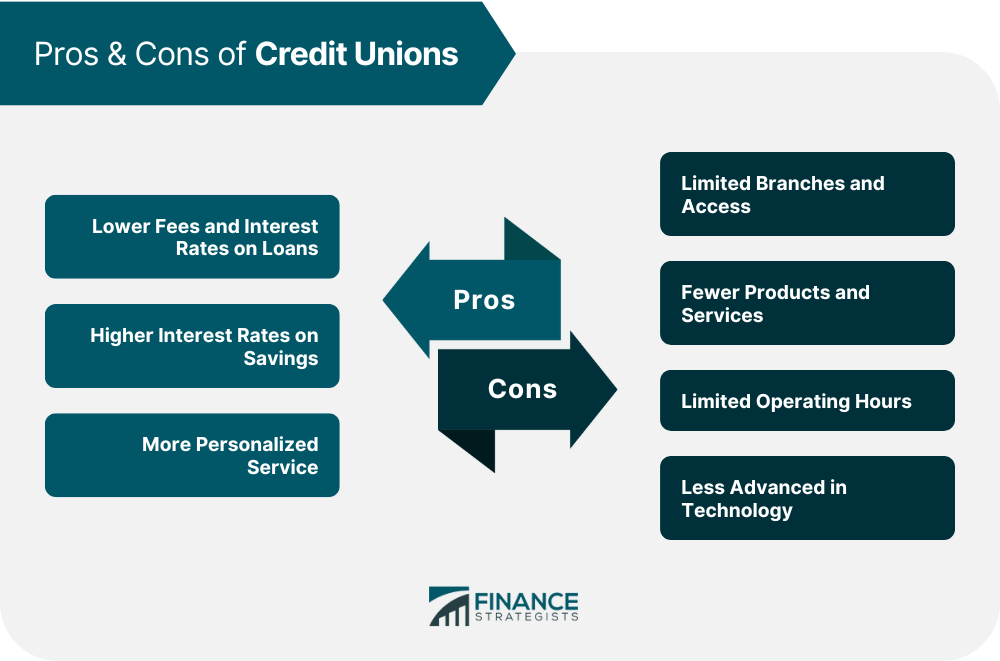

Joining a cooperative credit union supplies various advantages that can boost your financial wellness. Among the essential benefits is the potential for higher rates of interest on financial savings accounts contrasted to standard banks. Lending institution are member-owned, not-for-profit banks, permitting them to focus on supplying competitive rates to their participants. In addition, lending institution usually have lower costs and funding prices, assisting you conserve cash in the long run.

Another benefit of becoming part of a credit scores union is the personalized solution and community-focused approach. Unlike big banks, cooperative credit union commonly prioritize structure partnerships with their members and recognizing their unique financial needs. This can lead to customized financial services, such as customized finance choices or guidance on boosting your credit report. Furthermore, credit scores unions are recognized for their commitment to financial education and learning and empowerment, supplying sources and workshops to help members make notified choices regarding their cash.

Just How Credit Unions Deal Financial Education And Learning

Economic education and learning is a cornerstone of credit rating unions' philosophy, stressing the importance of financial literacy in achieving lasting economic wellness. Members benefit from finding out just how to successfully manage their money, plan for the future, and navigate intricate monetary systems. These instructional resources not only profit specific members yet likewise contribute to the total monetary health and wellness of the community.

Furthermore, credit unions may companion with institutions, community companies, and regional businesses to expand their reach and influence. By working together with external stakeholders, credit score unions can better promote economic education and encourage more people to take control of their financial futures.

Access to Competitive Lending Prices

To additionally enhance the economic wellness of their participants, debt unions offer access to affordable finance prices, enabling individuals to safeguard financing for various requirements at desirable terms. Wyoming Credit. Unlike traditional banks, credit history unions are not-for-profit companies that exist to offer their participants.

Credit rating unions commonly focus on the monetary wellness of their members over taking full advantage of revenues. This member-centric technique translates right into supplying financings with reduced interest rates, less fees, and extra versatile terms contrasted to lots of typical banks. In addition, lending institution may be extra prepared to deal with people that have less-than-perfect credit rating, offering them with opportunities to enhance their economic situations via responsible loaning. Generally, the access to affordable car loan rates at lending institution can dramatically profit members in attaining their economic goals.

Personalized Financial Advice

Members of lending institution take advantage of tailored monetary suggestions and guidance, improving their understanding of financial administration methods. Unlike typical banks, credit history unions focus on personalized service, making the effort to examine each participant's one-of-a-kind financial situation and goals. This personalized approach allows lending institution members to get targeted referrals on how to enhance their economic well-being.

Enhancing Cost Savings Opportunities

With a concentrate on promoting monetary development and security, lending institution supply numerous avenues for members to boost their financial savings chances. Cooperative credit union give competitive rates of interest on savings accounts, often greater than typical banks, allowing participants to gain a lot more on their deposits. In addition, several credit rating unions offer unique cost savings programs such as holiday interest-bearing accounts or youth cost savings accounts, motivating participants to save for certain goals or educate young people concerning the value of saving.

In addition, debt unions might provide deposit slips (CDs) with affordable rates and terms, giving participants with a safe method to save for the future while gaining higher returns than traditional savings accounts. On the whole, credit score unions existing diverse opportunities for participants to improve their savings and job in the direction of achieving their financial purposes.

Final Thought

In conclusion, lending institution offer countless advantages such as higher passion rates on interest-bearing accounts, reduced fees, and individualized monetary options. With access to affordable loan rates, tailored economic assistance, and curricula, lending institution offer a helpful setting to empower your funds and secure a brighter monetary future. Signing up with a cooperative credit union can assist you boost your cost savings opportunities and boost your overall monetary health.

Debt unions frequently supply workshops, seminars, and on the internet sources covering numerous topics such as budgeting, saving, investing, and credit scores monitoring.Economic education is a cornerstone of credit score unions' philosophy, stressing the significance of economic literacy in achieving lasting financial wellness. In addition, credit score unions might be more prepared to function with people that have less-than-perfect credit rating histories, offering them with chances to boost their financial scenarios via liable loaning (Credit Union in Cheyenne Wyoming).Participants of credit rating unions profit from customized economic suggestions and advice, boosting their understanding of financial monitoring strategies.Individualized economic guidance from credit scores unions typically consists of producing individualized budget plan strategies, establishing attainable monetary goals, and providing suggestions on improving debt ratings

Report this page